OPINION: Scammy vendors love pointing the blame finger at a big target like PayPal instead of just admitting they can’t process payments because their shady marketing tactics got them banned…

Now look before you start shaking your fist at me… Not everyone who gets banned from PayPal is a scammer, and not every scammer gets banned from PayPal. This article isn’t meant to imply that if you lost your PayPal account you are a defacto scammer and you deserved the hardship. But, for some people reading this, that shoe may fit quite snugly.

Don’t get me wrong, we are in an awesome industry. There is amazing potential here and this is the best time to get involved. We have built a life that many will only ever dream of and it is a true blessing. We’ve been able to accomplish this through the use of many platforms and services like WordPress, PayPal, JVZoo, D9 Hosting, Authorize.net, and frankly so many more that it would be impossible to name them all. There have actually been hundreds through the years.

To be clear, none of those platforms are solely responsible for our success. God is. We simply utilized those platforms along the way to achieve things. We continue to use many of the same platforms to run our day-to-day business even after 15 years.

Okay, now for the dose of reality… none of the platforms we use can ever be 100% perfect all the time because they are operated by humans and humans make mistakes. Things happen.

Usually, mistakes are unintentional errors in judgment by humans followed by an inappropriate course of action as a result. Sometimes those who make mistakes do the honorable thing by facing them and correcting them. Sadly, at other times, those who make mistakes chose to hide them or place the blame somewhere else hoping no one will notice. Not cool.

We have met some amazing, trustworthy, and honorable people online and forged some great lifelong relationships throughout our journey thus far. As amazing as this industry is there are also quite a bit of unscrupulous people out there polluting the waters we drink from. This is nothing new in the world, evil has existed since the garden of Eden. It is definitely not new to this industry because I’ve seen many shady characters come and go throughout the years.

One issue that circles around every year deals with payment processors, specifically PayPal. It’s almost identical each time, someone, usually a vendor makes a post about how PayPal, the big bad wolf shut them down “for no reason at all”. They project the victim role. It almost always happens during or immediately following their product launch and it’s NEVER their fault. Ever. How could it be? If it were then they would be projecting a bad image about their business tactics to new customers, prospects, and affiliates that may be currently promoting their launch. It can NEVER be about the vendor it must be about the biggest and closest target. PayPal.

Because of course, PayPal employs a team of people to go around and suspend, limit or terminate accounts that are in good standing and generating a large amount of money for them legally and legitimately. Of course, PayPal loves to terminate accounts that have hundreds and thousands of happy customers. Of course, PayPal loves terminating accounts with glowing reviews and near-zero complaints, disputes, or chargebacks. That must be it… Right?

Almost immediately there will be one, two, or three other vendors that jump on the thread to agree. “Ohh, Emm Gee! You too? We were shut down for absolutely no reason whatsoever last week. We did nothing wrong, PayPal is EVIL!” … “How could they do this to us?” they exclaim. Now the pile on begins. Every arse licker and their sister jumps on to support their potential affiliate who they need a reciprocal mailing from next week and the circle jerk ensues. Tale as old as time.

Next, come the self-proclaimed internet lawyers and PayPal terms specialists to educate us little guys on the way the world spins within the boardroom of a three-hundred and fifty billion-dollar company. You know the type, they are experts on whatever topic is trending so they can hear themself talk. They are experts in matters of cryptocurrency, epidemiology, racial injustice, geopolitical affairs, and of course… PayPal restrictions.

Ultimately, a newbie can’t help but be afraid. Afraid of the industry giants like PayPal and Stripe because after all who can argue with all the victims and experts on that social media post? Surely not a newbie like them. It’s almost comical yet concurrently quite sad to watch this happen in real-time. It often gets ugly on these threads and people tend to form cliques and dogmatisms towards their preferred people and platforms. This behavior and lack of informed discourse aren’t much unlike what we see in most public arguments over social issues nowadays.

Not to be reasonably withheld I can say this, PayPal usually isn’t the problem. Usually, the person bitching about them is. Can there be an exception to this? Of course, that’s the human factor. Could someone at PayPal have made a mistake when reviewing an account or handling a complaint? Of course, they could have. Is that likely the issue in all these cases that you see people bitching about on Facebook? No. No, it’s not. Occams razor dictates that it’s most likely NOT the big bad wolf mass suspending accounts but rather that the person suspended did something to deserve it.

Yes, I know that’s a hard pill to swallow but it is the most reasonable and logical conclusion. The vendor or affiliate in question violated PayPal’s user agreement at one point or another and it has finally caught up with them. That vendor or affiliate was flagged by the risk assessment team for unusual activity. Is the flag “always” correct? No, not always but in most cases, Yes it is. Chances are that the vendor or affiliate is posting about it publically and positioning themselves in the victim role to save face and try to get in front of the issue. After all, image is everything in marketing and how could you be teaching people marketing concepts and selling marketing tools and software if the biggest online payment processor in the world refuses to work with you?

Today I witnessed a brouhaha of a thread on Facebook about an issue regarding payment processors. A customer tagged a vendor in a post asking them to clarify a few things about their product quality and online business practices. When asking for a refund, the support team told the customer to go file a dispute in PayPal. That is a very unusual response because vendors tend to AVOID disputes and chargebacks. Those things HURT your standing with the payment processor as a vendor and when you get enough claims filed against you they put you on what’s called a TMF Match List. That’s basically a blacklist that prevents you from opening accounts at any type of banking institution for a number of years. It’s almost impossible to get off the list and it can literally bankrupt any business.

When asking for clarification from the vendor in this case the customer felt ignored so he posted about it on Facebook and tagged the vendor. The vendor wasn’t happy about that of course and he reached out to the customer privately after commenting on the original post with some cryptic non-answer type of comment. As the brouhaha etiquette dictates there were all sorts of colorful characters chiming in to give their expert opinions including another vendor explaining how he is FORCED to handle refund requests the same way because of the way the big bad platforms now manage refund requests. Both vendors were implying that this is simply the way to do things moving forward. As if they are patient zero of a new PayPal variant. One of these vendors literally said that the affiliate platform they use TOLD them to ask their customers to file a dispute at PayPal or a chargeback with their credit card company whenever their refund button” spits out an error.

Now, let’s pause here and take a moment to absorb this.

When I read that vendor’s comment I made a face that looked like Macaulay Culkin putting on aftershave for the first time in Home Alone. I was shocked to say the least. Chargebacks and disputes are NEVER something to encourage. The very premise of encouraging or recommending a dispute is simply wrong in any context, in any subject, on any level. It is always better to settle things amicably than with a dispute. It was very hard for me to accept that any reputable affiliate platform would tell their vendor to encourage a customer to file a chargeback or dispute which would only end up HURTING the account holder’s business.

Here’s why this is a dangerously bad practice for vendors… the dispute process is not meant for refunding, creatively enough that’s what the REFUND button in PayPal is for. Affiliate platforms also have a refund button that digitally tells PayPal to process the refund and conveniently returns all fees and percentages to their correct place of origin. The dispute process is for FIGHTING a charge, not for refunding, that’s why it’s called a “dispute”. Filing a dispute implies that you do not agree with the charge. When a customer files a dispute PayPal only gives the vendor a few options to remedy the situation and all of them require admitting GUILT.

Disputes generally fall under three categories:

-

- Item Not Received. A buyer pays for an item but never receives it

- Significantly Not As Described. A buyer receives an item that’s significantly different than what they ordered.

- Unauthorized Transactions. A buyer claims a purchase was made without their consent.

The only alternative to accepting one of those three guilty verdicts as a vendor would be to escalate the dispute into a CLAIM. This changes everything in an otherwise automated process and now pulls in a manual reviewer to examine the facts of the case. Now the vendor must explain what happened and supply PayPal with PROOF that the transaction was legit on their part. The PayPal reviewer will then make a decision on whether or not to process the refund and reverse the charge. By the way, PayPal also pockets the service fee even if the item is refunded and in cases of chargebacks will charge the vendor an additional $20 fee per transaction for handling the resolution.

That’s not the worse part of disputes and chargebacks for vendors. When you accumulate enough of these nasty stains on your account, PayPal will mark your account as “high risk”. Rightfully so after all you are accepting GUILT over and over again when people say you shouldn’t have gotten their money. This is the point where PayPal enforces limitations and reserves on your account till they see an improvement. That’s if they want to be nice, otherwise, they just shut you down and they may or may not even give you a farewell pat on the head or an explanation of any kind. You should count your lucky stars if you didn’t end up on the TMF Match List and you can still try to open a merchant account somewhere else.

Now, knowing these FACTS. Why on earth would any vendor instruct an unhappy customer to go file a dispute or lodge a chargeback complaint with an underwriter? It’s insane. Of course, it’s possible that the vendor is just inexperienced, naive, or ignorant but it’s even more insane for an AFFILIATE PLATFORM to tell its vendors to do this. That’s where I pumped the breaks on this thread. We would presume that affiliate platforms know the risks and would not want to put their vendors (and themselves) in harm’s way with such a dangerous process. By the way, I’ll give you three guesses as to what platform these vendors were launching on but you’re only going to need one.

I digressed. The vendors in question were insistent that they had done nothing wrong of course, and as expected they continued to take a rather virtuous and sanctimonious position on the matter. Ultimately some real experts that actually run an affiliate network appeared on the thread to ask some difficult questions. When confronted, the questionable vendors began throwing around the term “PayPal broker” and saying they have limited access to the broker’s account.

Wait… What?

What the heck is a PayPal “Broker”?

Good luck googling that one. It’s basically a term shady characters invented in their attempts to legitimize the act of using someone ELSES PayPal account to sell their product.

Now ask yourself… “why would a vendor need to use someone else’s PayPal account to sell their own product on their own sales page?” hmmm. My spidey sense is tingling. How about yours?

There are really only a couple of ways this makes any sense.

- The vendor cant use their own PayPal account to process payments because they were either limited, restricted, or just shut down (due to perfect behavior and no wrongdoing of their own of course.) Therefore PP is controlling the refund capability because they’ve been locked out of their own account.

- Since the vendor isn’t using their own account and they have paid a “broker” to use their account, the vendor doesn’t have access “broker’s” refund button either and really could care less about that “broker’s” account so they can tell people to file chargebacks all day. After all, it’s not their account that will be shut down this time, its the “brokers”

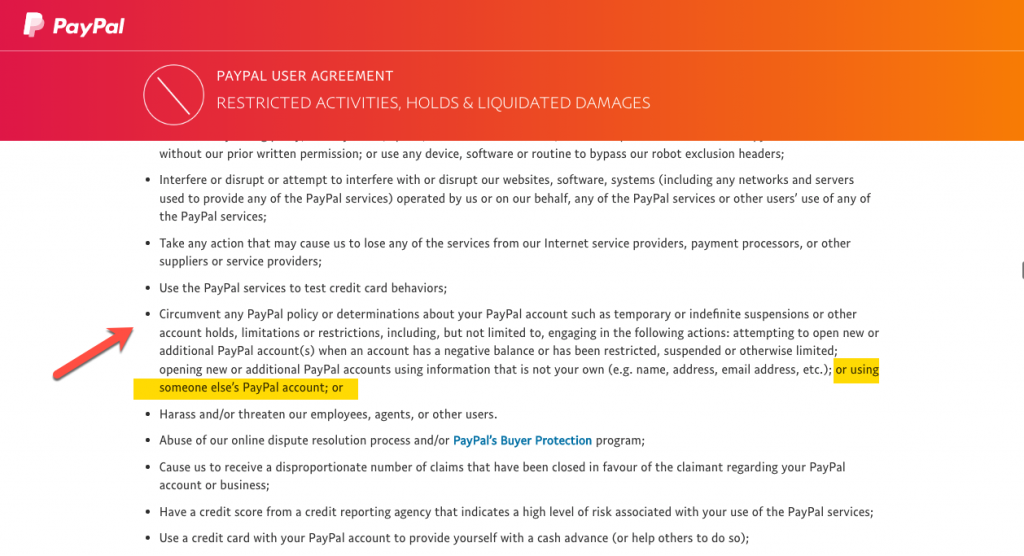

Please understand that this whole “PayPal Broker” concept is against the rules of Paypal. You can see it for yourself here under Restricted Activities in their user agreement.

Figure 2 PayPal User Agreement Restricted activities

There is no debating whether or not it is okay to use someone else’s PayPal account to sell your product. It is clear as day right in PayPal’s user agreement under the restricted activities section (Fig 2.) But these shady vendors will do mental gymnastics to try and justify their chicanery.

In the end, one of the vendors in question actually had the cojones to say that his own PayPal had been shut down for having “just a few” chargebacks. Yet he encourages people to go and file disputes and chargebacks. One of the vendors even went as far as posting the exact email he sends customers telling them to go file a chargeback. He was proud of the cutting-edge process he was now implementing in his business.

A slightly deeper dive into the product that the vendor in question was selling revealed a plethora of fraud and dishonest business practices. Their sales page literally used a fake persona to portray the vendor. The sales letter portrays the vendor with a fictitious character using a stock image purchased from one of those royalty-free photo sites. A quick reverse image search on Google proved the lengths to which these vendors would go to snatch up people’s cash, including up to even faking testimonials from “users” that are also apparently stock image models. The income claims were completely over the top and obviously bogus. Even the sales video was made of pure hype.

These sorts of vendors hurt our industry in more ways than one and it’s not good to look away and pretend like it’s not happening.

“We must all fear evil men. But there is another kind of evil which we must fear most, and that is the indifference of good men.” ~ Boondock Saints

Their bad behavior puts us all under a microscope. When PayPal and perhaps even the FTC swing their hammer it will come down hard and wide. It won’t only affect the scammy vendors we speak of here but also the affiliate platforms that enable them. I’m pretty sure that a company like PayPal with 400 million users that processes $886 billion dollars per year (that’s Billion with a B) could care less about shutting down an affiliate network that contributes a measly ten million. Our industry is peanuts to them and they won’t risk their business over it. Sadly, not if but when they shut down an entire affiliate network for enabling this type of behavior, those few good ethical marketers on there will lose their accounts too. Ohh and good luck trying to access your “wallet” when that happens. Have you ever checked if that money was FDIC insured? Hmm. Probably not.

You should be prudent about who you do business with as a consumer, as an affiliate, and as a vendor. There are shady characters out there purporting to be ethical marketers. Their headlines are false, their user testimonials are fake and they hide behind stock images of models. They use attractive sales pages with fake income proof to bait people in. Their shenanigans have cost them their own PayPal accounts so now they violate PayPal’s terms of service by renting the accounts of others they call “brokers” so they can keep selling people their snake oils and wares. They dangerously train customers to file chargebacks and disputes because they could care less about the accounts they are renting. This puts a strain and an unwarranted expense on the Payment Processors and underwriters which brings attention to our industry. It puts us ALL under a microscope.

In conclusion, know that it is not okay to play these sorts of games with PayPal. When you play stupid games you win stupid prizes like limitations, restrictions, and shutdowns. But not only that, it hurts the entire industry. We are not perfect, God knows I’ve made a lot of mistakes over the decade and a half we’ve been doing business online. However, when it comes to payment processors we have never been shut down, banned, limited, restricted reserved, or any of those things in spite of having processed millions and millions of dollars. I’m not trying to paint a halo on my head but I do have a recording of our PayPal account manager telling us that we are the ideal type of client PayPal likes to work with.

So yeah, while the big bad wolf was “wrongfully” shutting down all those “poor honest vendors” accounts, that same big bad wolf told US that we are “ideal clients” doing business the right way, go figure. Do your own research when deciding who you’re going to work with.

Anyone can get jammed up for making a mistake. I think it’s in those moments when life tries us that we have a true opportunity to shine as children of God. I haven’t always done the right thing, I’m human, but I try to admit when I’m wrong and make the necessary correction. It’s not always easy to admit we’ve done something wrong but the path of least resistance makes men and rivers crooked. There are vendors out there which will lie to protect their image, they are in it for the cash grab and they don’t care about the carnage they create. Don’t fall for them. Don’t be like them. Don’t be indifferent. Shine.

Grace and Peace.

11 replies to "IS PAYPAL REALLY THE BIG BAD WOLF OF INTERNET MARKETING?"

This is an awesome article!

First, I must say that I agree with you. PayPal certainly isn’t in business to kill its own business by randomly disabling accounts. That is just absurd.

As far as moronic and dishonest vendors go, I have requested refunds for products that turned out to be garbage or that were misrepresented. Either the vendor completely ignored the support tickets, or as you said, told me to file with PayPal. That takes 2-3 months to complete. Both are dishonest. Don’t make claims that you have no-questions asked refunds or say there in no risk, try it and if you don’t like it, we will refund your money, then refuse to do it. As you said, it makes all vendors, even the honest ones, look bad.

I remember the post you are talking about.

I went to the sales page and didn’t have to go very far before I figured that even if someone I trusted told me to buy this, I would not have done so. The claims in even the first quarter of the sales page raised so many red flags for me.

This is definitely a great post and full of valuable information about how to do business as a person with integrity and value. I do believe that those that are doing business in a shady manner will always have some kind of dispute because they already know deep down inside they are up to no good. It is a good feeling to know that you and Melinda are the good guys in this industry full of deception and lies, indeed there are many great honest people out there doing legitimate business, but the bad ones are definitely making a bad name for others out there just trying to make an honest living

I checked out the page in mention and WOW, I can’t believe a product like that is actually being spread around like as if it was a product to actually bring the results on the tin. It is full of hype and false advertisement and probably could be used as a template for how not to create a product but yet this particular product in mention was also a product of the day so it tells me maybe there are a lot more products going through this place with no filter as to whether or not some products are legit or just shady bs. It kinda makes a person think twice about even doing business on such platforms.

I swear I did nothing wrong…

Oh Wait – I’ve used paypal for over Twenty Years without issue.

I have called them, I have clicked to provide more info on occasion, and yep, I’ve even had some customers dispute, instead of just asking for a refund.

I’ve also had a lot of transactions go through paypal, from various platforms over the last twenty years.

And so far – touch wood etc.- I’m still able to continue using my paypal account 🙂

I just wish you would have named names in your article Omar… so we know whom to avoid 😉

Randy

I love this article and I have seen these complaints about PayPal in the past. Some has even used it to promote fear selling thier own products.

PayPal makes doing online business so much easier especially when tracking purchases and costs over the year where you can purchase everything using one platform. But these days I see more and more products not being sold through PayPal. And yes, I have heard the horror stories some marketers give.

It makes no sense to me that a huge business such as PayPal would want to get a reputation for hurting their members instead of helping them. I have been doing business with them for over 30 years and have never had a problem. But that is just me.

Good article that made a lot of sense.

It goes without saying (or it should) that you are spot on here Omar. I’ll join others in saying Thank You for a great and informative article.

As yea sow, so shall yea reap. Those who act as you’ve described are reaping the results of their actions but unfortunately you’re right in saying that so may innocent.

Customers (at least those new to the business) can’t be expected to discern the pitfalls out there but affiliates should know better.

This is the primary reason that I’ve cut way back on things I’ll promote, as I don’t want to support the bad guys. Is it just me or does the trend toward offering a lot of **@! seem to be increasing? Or perhaps I’ve just become more attuned…

Great post.

But nope.

Seen all those arguments for both sides a million times before.

Can only go from my own experience when they withheld a fairly decent Affiliate payout from me for 6 months and I told them at the time they can get stuffed.

But I take your point.

Great analysis of both the Paypal issue and of the need for those of us who place integrity before profits to speak up when we see the bad actors in our industry. Many of us, particular those new to the industry, take the over-the-top hype and promises as the only way to succeed. I was crushed to read that one of the products that drew a ban from Paypal was promoted as a product of the day. Many industries manage themselves with a “stamp of approval” by a governing board (would you buy an electrical device that was not certified?). Perhaps our industry has grown to that point.

I’m not sure what I’m doing with this

Take your time.